In this article

Why should banks and fintech companies care about the prevention of money-laundering?

Why you need AML compliance training at your bank or fintech company

What makes Ethena’s AML training stand out?

If your goal is to interrupt bad behaviors before they spiral into something more insidious (and who doesn’t have that goal?), then there’s hardly a better place to start than with money-laundering prevention.

A financial crime begins as transactional aberrations, something that a robust compliance program can often spot… but that, if not detected early, can balloon into global issues with connections to felonies like terrorism, human trafficking, and organized crime. So individuals and companies alike are incentivized to get educated on:

- How to identify money-laundering activities

- How to respond to them

- Who to loop in and when

- The intricacies of any anti-money laundering (AML) processes already in place

And since the moment for that education is before an issue arises and not after, let’s get into it: what are ways to prevent money laundering?

What is money laundering?

Money laundering is a financial crime that attempts to move ill-gotten or “dirty” funds through a process that hides the money’s shady origins. If cash moves successfully all the way through the three stages of money laundering — placement, layering, and integration, which we get into more detail in another post — it comes out on the other end seemingly “clean,” stripped of its criminal associations.

And the aim, of course, is to interrupt the above process at any point to ensure that illicit funds don’t find their way back into the economy and to prevent your organization from potential fines, exposure to risk, and other bad turns.

Why should banks and fintech companies care about the prevention of money-laundering?

There are plenty of reasons for banks, money-service businesses (MSBs), and fintech companies to care about money-laundering prevention, and they range from the legal, to the ethical, to the financial, and beyond. But they all share the same core reasoning: catching issues when they’re small prevents countless headaches down the line.

Who doesn’t want to shield their company from potential risk, fines, legal battles, bad press, and save themselves future stress?

How does AML training fit into the bigger picture of preventing money laundering before it ever starts?

As a reminder, AML compliance training is just one part of a rigorous prevention program, and it serves mainly to help your workforce identify past errors that might need addressing or correcting, as well as provide education on current behaviors and best practices. Typically, the goal of AML compliance training is:

- It helps employees understand what money laundering is

- It helps them learn how to identify its earliest signs

- It shows them how to report concerns before they spiral into something bigger

It’s in the actual implementation of these best practices that we start to see the bigger picture. Ethena’s AML training is excellent, but it can’t future-proof your company from risk — no training can.

If you want to know how to stop money laundering, that work must come from within. A top-down commitment to sticking with policies and processes long-term can include:

- Ongoing transaction monitoring

- Cultural initiatives

- Know Your Customer (KYC) practices

- Effective Code of Conduct training

- And more

Why you need AML compliance training

With its frequent connections to devastating crimes like terrorism and human trafficking, there’s a moral and legal incentive to money-laundering prevention. But AML training is also particularly applicable for the following three reasons:

1. Liability issues

As we’ve already noted, many companies are literally required to have robust AML programs in place. And with regulatory fines skyrocketing as of late, even an unintentional lapse can lead to costly fines, steep penalties, and loss of corporate trust.

2. Future business connections

But even those companies that aren’t (yet) legally required to implement an AML program might find it challenging to drum up business opportunities. That’s because many companies are now insisting on a higher standard for their own partners and counterparties when it comes to AML processes.

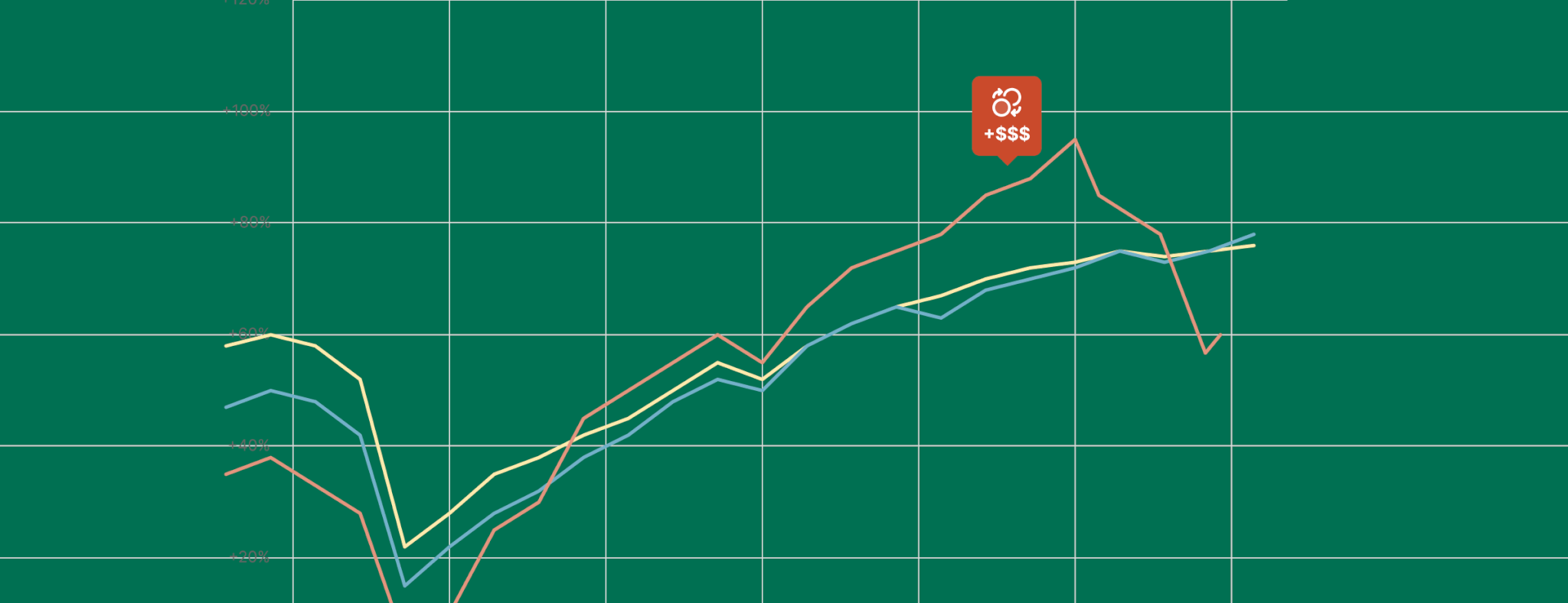

3. Ongoing expansions

Some geographic areas are higher risk than others. So if your business is growing, an expansion — while exciting! — could also come with unforeseen money-laundering risks that an AML program could help illuminate for employees.

What makes Ethena’s AML training stand out?

So why are we steering you toward our very own AML course? We’re biased, of course, but our best-in-class training is thoughtfully designed to:

- Contribute to legal compliance requirements,

- Engage the learner (so that behaviors change)

- Align with your internal goals,

- Save time for busy administrators

Here's how!

Seamless HRIS integrations

The majority of the time, when we’re asked during a sales call whether our platform supports a certain integration software, the answer is a resounding yes. Our current software integration partners include BambooHR, Rippling, Gusto, and Workday to make onboarding a breeze, and our training reminders can go out via Slack or email with the simple press of a button. (Good news if you love intuitive, time-saving systems, but bad news if manual data entry and chasing folks down are your beloved hobbies.)

Documentation at your fingertips

When (and if) regulators ever come knocking for proof of which employees have completed which training and when, you won’t have to scramble to locate it. The Ethena platform retains a snapshot of the who-what-when of any given training module to keep you audit-ready — just in case.

Actually good training content

We were co-founded by two women who were fed up with boring compliance training. It didn't change the workplace. It didn't change employee behaviors. It didin't...do anything but check-the-box. Well they started Ethena on harassment prevention to change all that.

Typical AML compliance training: traditional training that technically checks-the-box regarding legal requirements but is so bland, jargon-y, or out-of-touch that employees consistently walk away without learning anything.

Modern AML compliance training: Ethena’s research-backed training, developed in partnership with our legal team and subject matter experts, is written clearly and accessibly by our skilled and extremely humble content team (hi!).

It's also brimming with compelling multimedia elements like comics, video, audio-only, and more. We also emphasize relevant, modern scenarios that feature characters with a diversity of races, cultures, and abilities because if your training doesn’t slot neatly alongside your progressive DEI goals … what’s the point?

That’s enough of us chattering at you now — how are you feeling? Ready to join existing Ethena customers like Carta and Robinhood who currently receive our training, or are you still on the fence? If you have any lingering questions, let’s talk about them, or you can request a sample training today!