Anti-Money Laundering (AML) Training

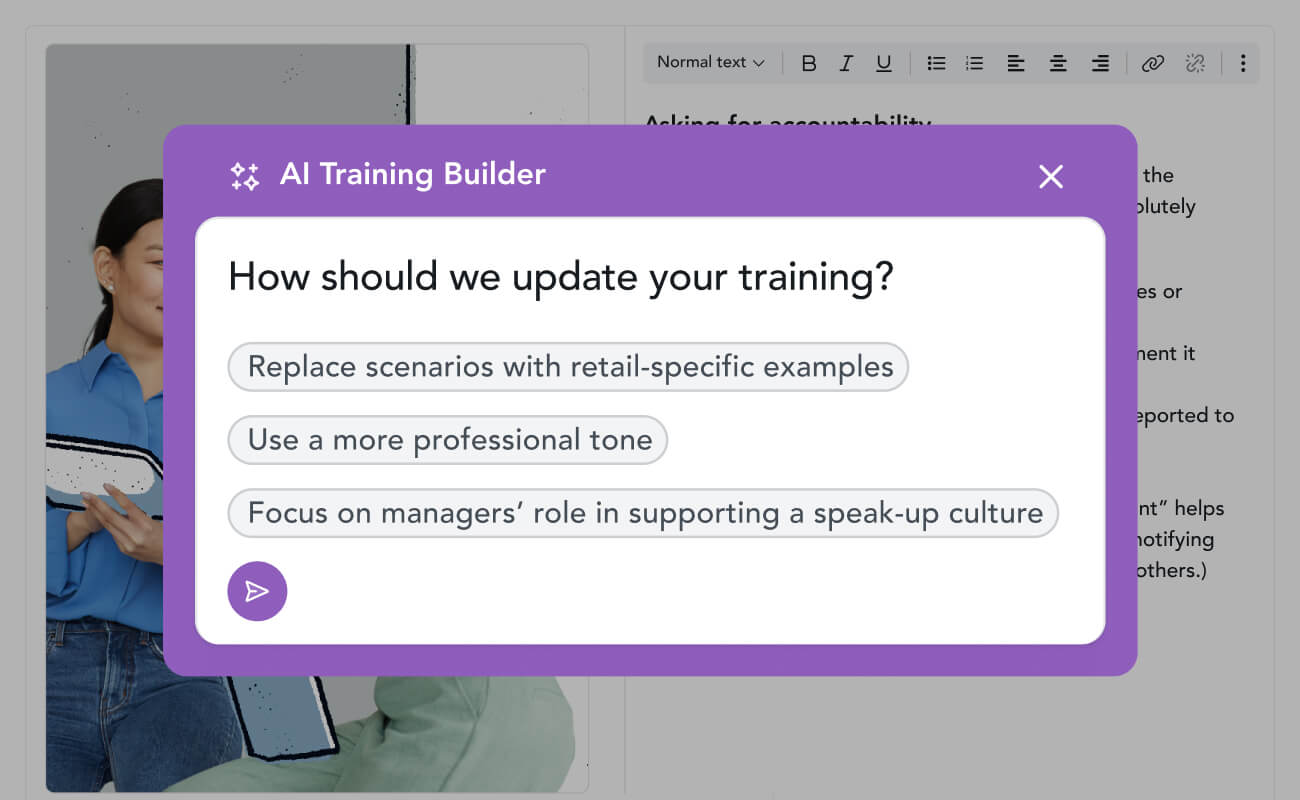

- AI authoring tools for easy customization

- Additional languages available

- Meets accessibility standards

- Auto-save training, mobile-friendly

- Deliver on Ethena or your LMS (SCORM)

Included Modules:

Introduction to AML

A level set on the importance of anti-money laundering (AML) training and awareness including real-world examples.

AML Basics

Defines the three stages of money laundering, money service businesses (MSBs), and the characteristics of a healthy AML process.

AML Legal Landscape

Outlines US money laundering laws including the Bank Secrecy Act and USA PATRIOT Act, stressing potential impact on non-financial institutions.

Know Your Customer (KYC)

Breaks down what a healthy KYC program includes, why it’s important, and defines important concepts like beneficial owner, CIP, CDD, and EDD.

Transaction Monitoring and Reporting

Covers requirements under the Bank Secrecy Act for monitoring customer activity, including when and how SARs and CTRs are filed.

AML Review

A quick recap on what was covered in this course, highlighting the importance of Bank Secrecy Act basics, KYC, and reporting suspicious activity.

Learning and compliance with AI at the core

Your training copilot

Built-in AI uses your policies and prompts to customize Ethena’s top-rated content painlessly, while controls keep you compliant.

AI authoring >

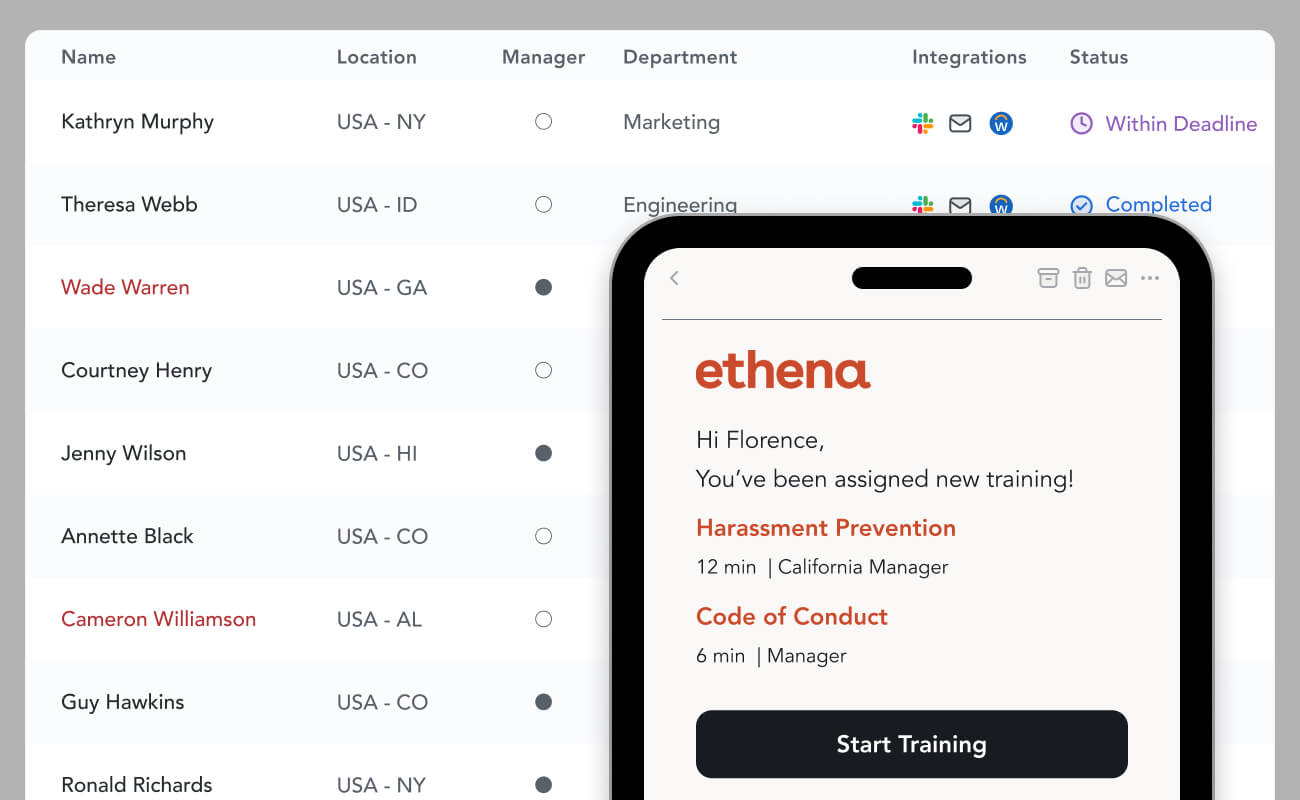

Assignments automated

Sync HRIS data to automatically deliver the right training to the right learners with automatic reminders. No more spreadsheets.

Assignment automation >

Localized content

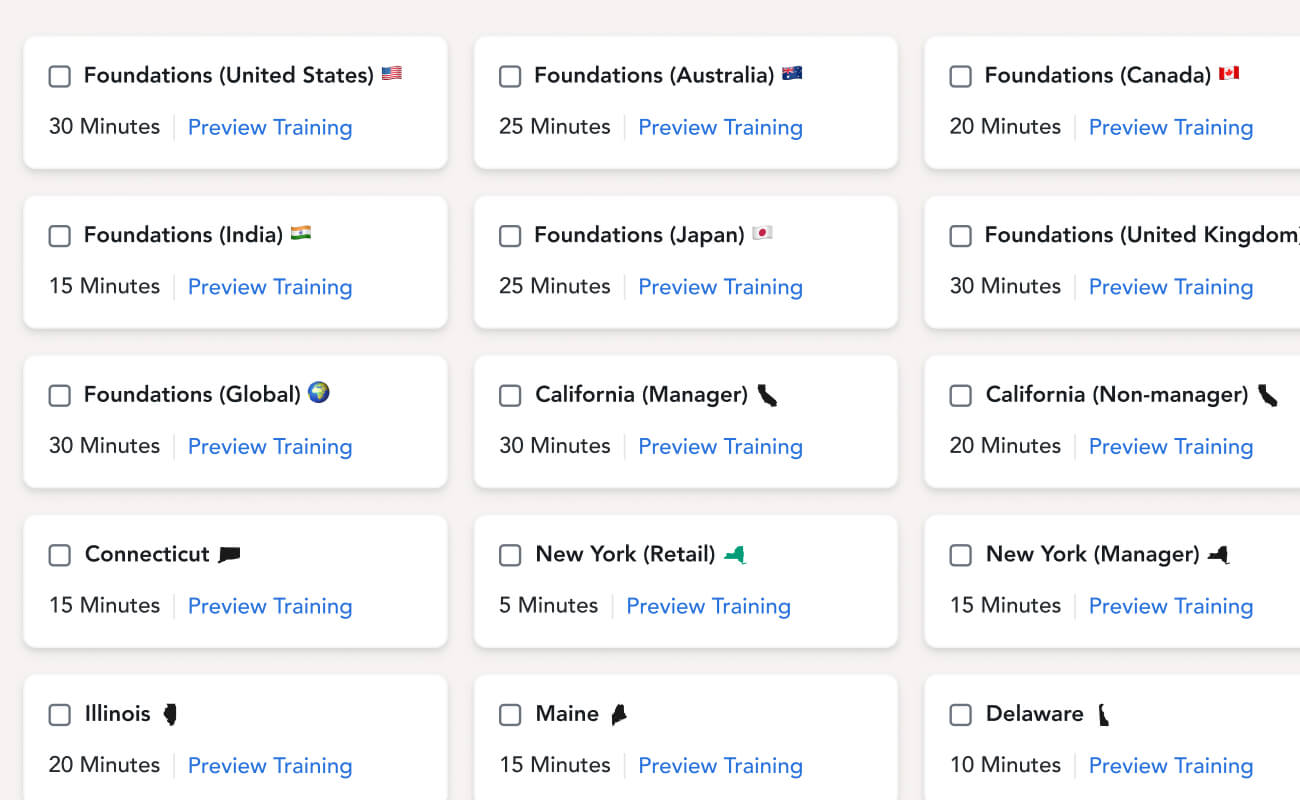

200+ modular courses meet local, state, and country legal requirements, with fast and free translations available in dozens of languages

See courses >