Code of Conduct: Anti-Money Laundering & Customer Due Diligence

- Included with Code of Conduct course

- Deliver on Ethena or your LMS (SCORM)

- Auto-save training, mobile-friendly

- Meets accessibility standards

- AI authoring tools for easy customization

Learning and compliance with AI at the core

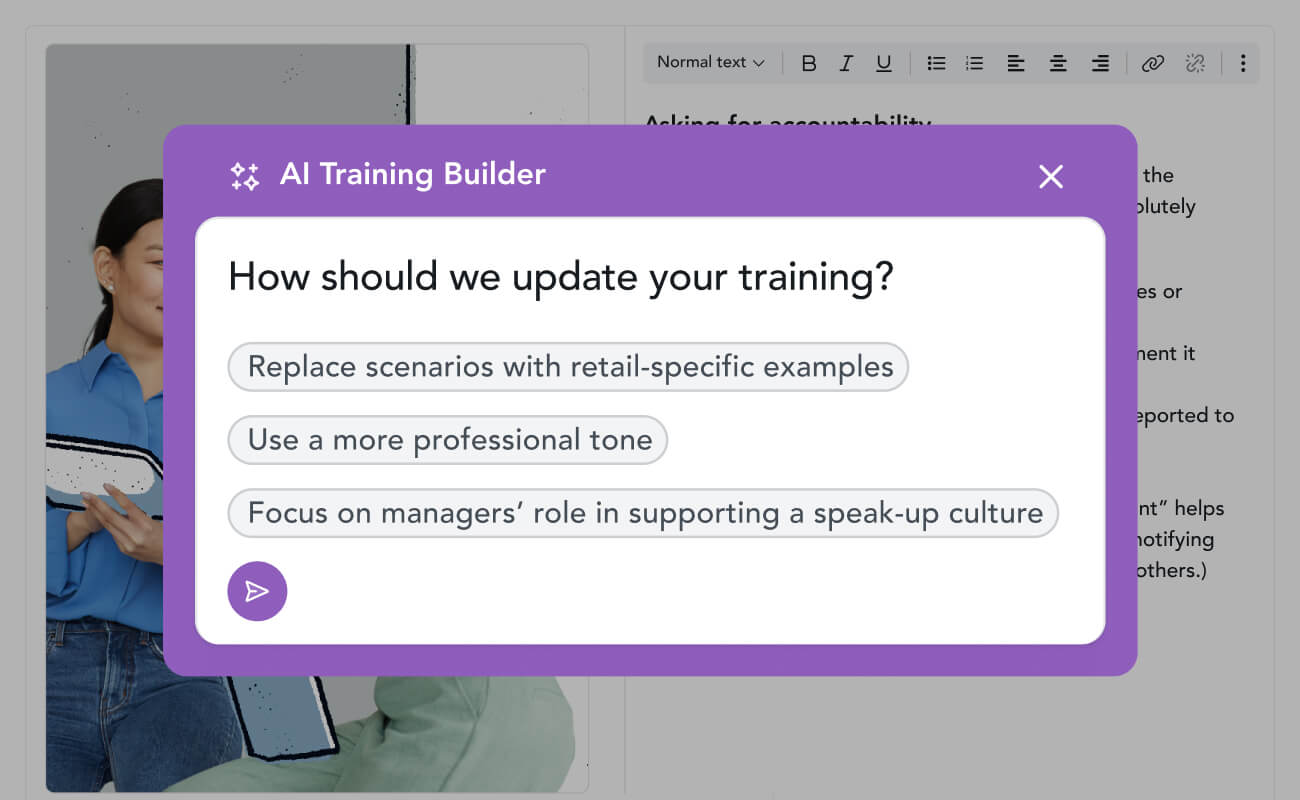

Your training copilot

Built-in AI uses your policies and prompts to customize Ethena’s top-rated content painlessly, while controls keep you compliant.

AI authoring >

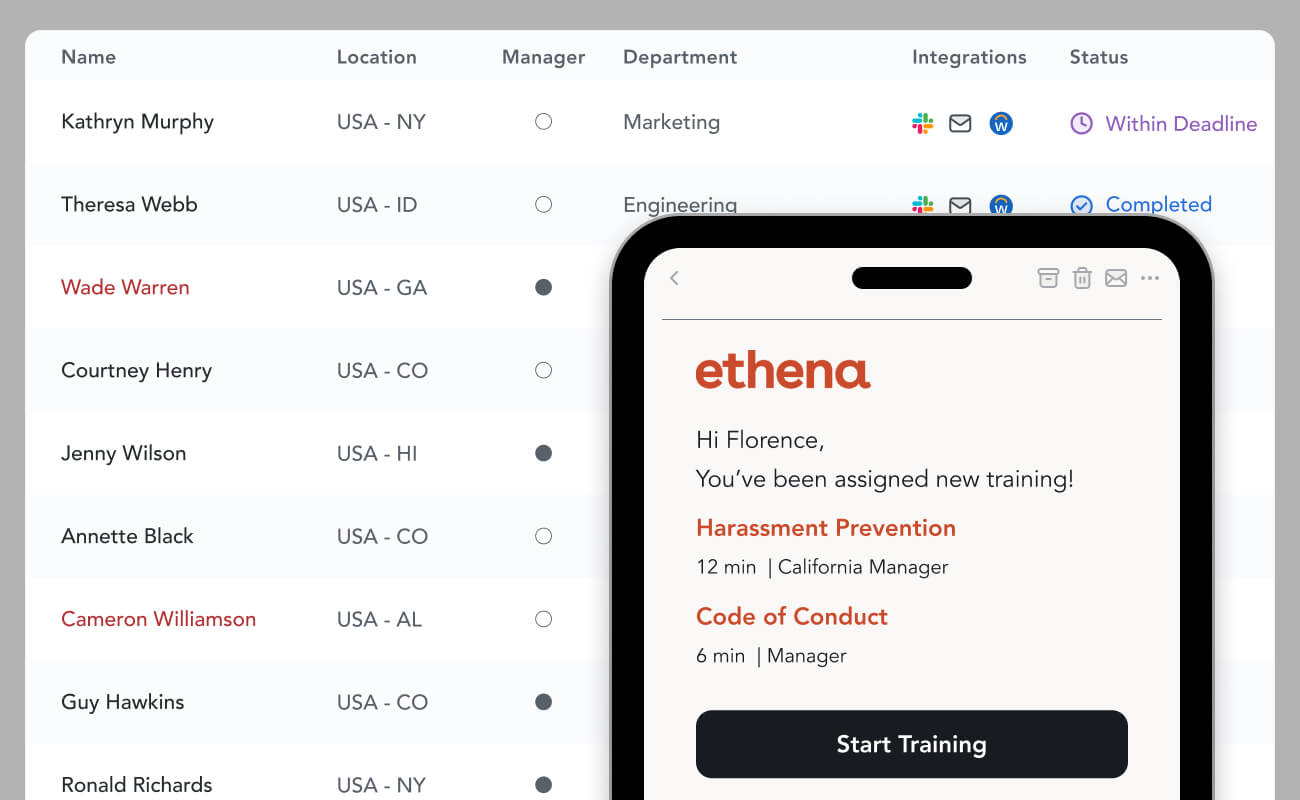

Assignments automated

Sync HRIS data to automatically deliver the right training to the right learners with automatic reminders. No more spreadsheets.

Assignment automation >

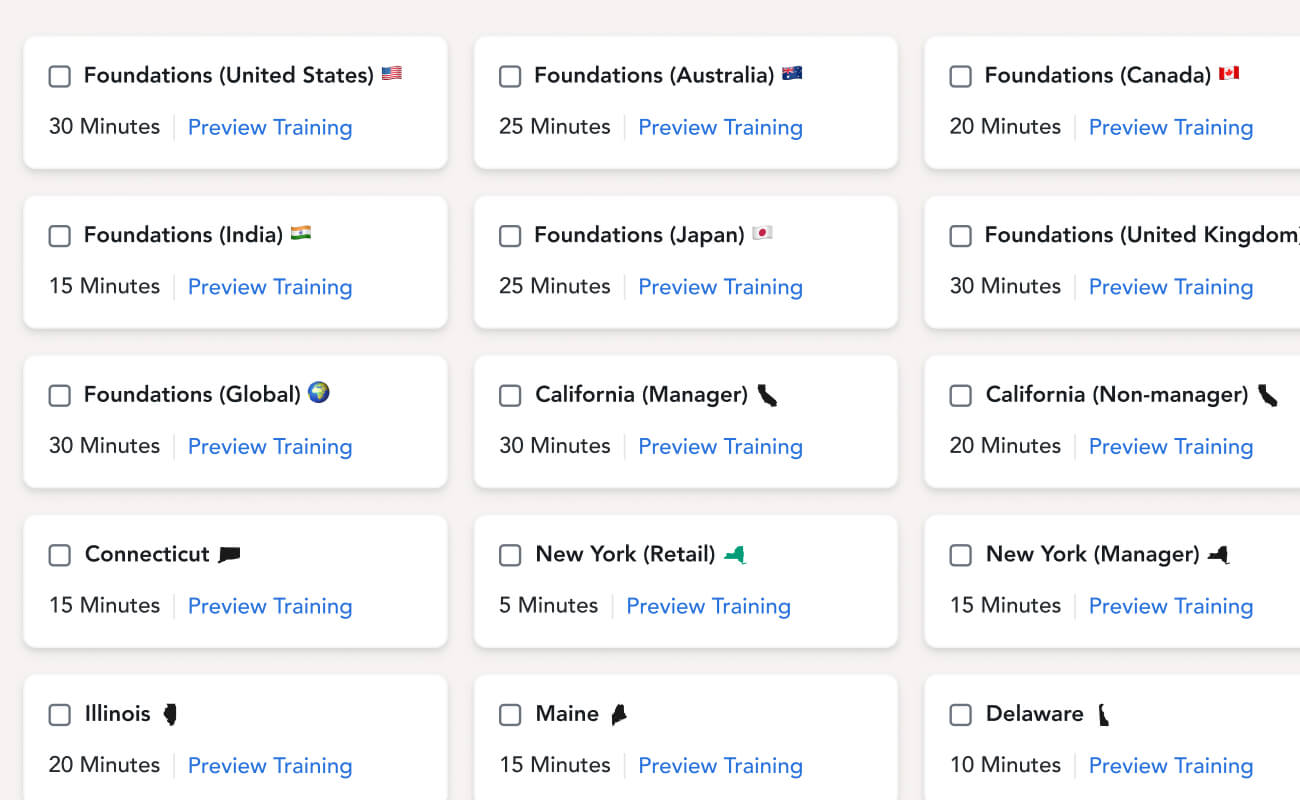

Localized content

200+ modular courses meet local, state, and country legal requirements, with fast and free translations available in dozens of languages

See courses >